How does mortgage automation translate into better customer relationships? Mortgage automation means faster loan processing. To put this general statement in perspective, a CVISION client saw a 96% increase in loan processing efficiency after mortgage automation.

Differentiate Your Mortgage Application Process with Real-Time Service

While the statistic above has obvious implications for improving the loan approval workflow itself, there is a hidden, greatly beneficial consequence of this: faster approval means better service for borrowers. For instance, by the time a potential borrower has submitted a mortgage application, they’ve likely narrowed down their options to the point where loan rates and terms are no longer differentiating traits. What this means exactly is: If a mortgage lender can be the first to approve that borrower for a loan, they are more likely to earn the business than their competitors.

Further, automation can lead to such a large jump in mortgage loan approval speed that happy borrowers can be impressed enough to share their experience with their neighbors, friends and family. Before mortgage automation, a Fortune 500 financial institution spent 2 hours processing each loan packet, but after implementing automated classification and data extraction software, each packet took less than 5 minutes to process!

In the Digital Age, Stronger IT = Competitive Advantage

In the age of digital transformation, this is the real-time level of service customers have come to appreciate and even expect. When a need is met immediately it can translate to positive word of mouth and further dominance over less IT-savvy competitors. Through mortgage automation software, banks and financial institutions can not only improve internal loan processing efficiency but also provide an enhanced, streamlined customer experience.

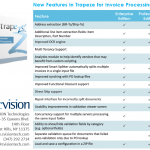

Why wait to improve your business with mortgage automation? Stay one step ahead of your competitors with CVISION’s Trapeze for Mortgage Processing.