It’s no secret that automated document classification and data extraction can mean big savings for insurance companies. With automation, reduced labor costs and greatly accelerated processing speeds await those still relying on manual data entry to process the huge volumes of paperwork inherent to the industry. But what are the deeper consequences to these new efficiencies? How exactly can document automation translate to better value for members?

Reduced Claim Processing Costs Per Member Per Month

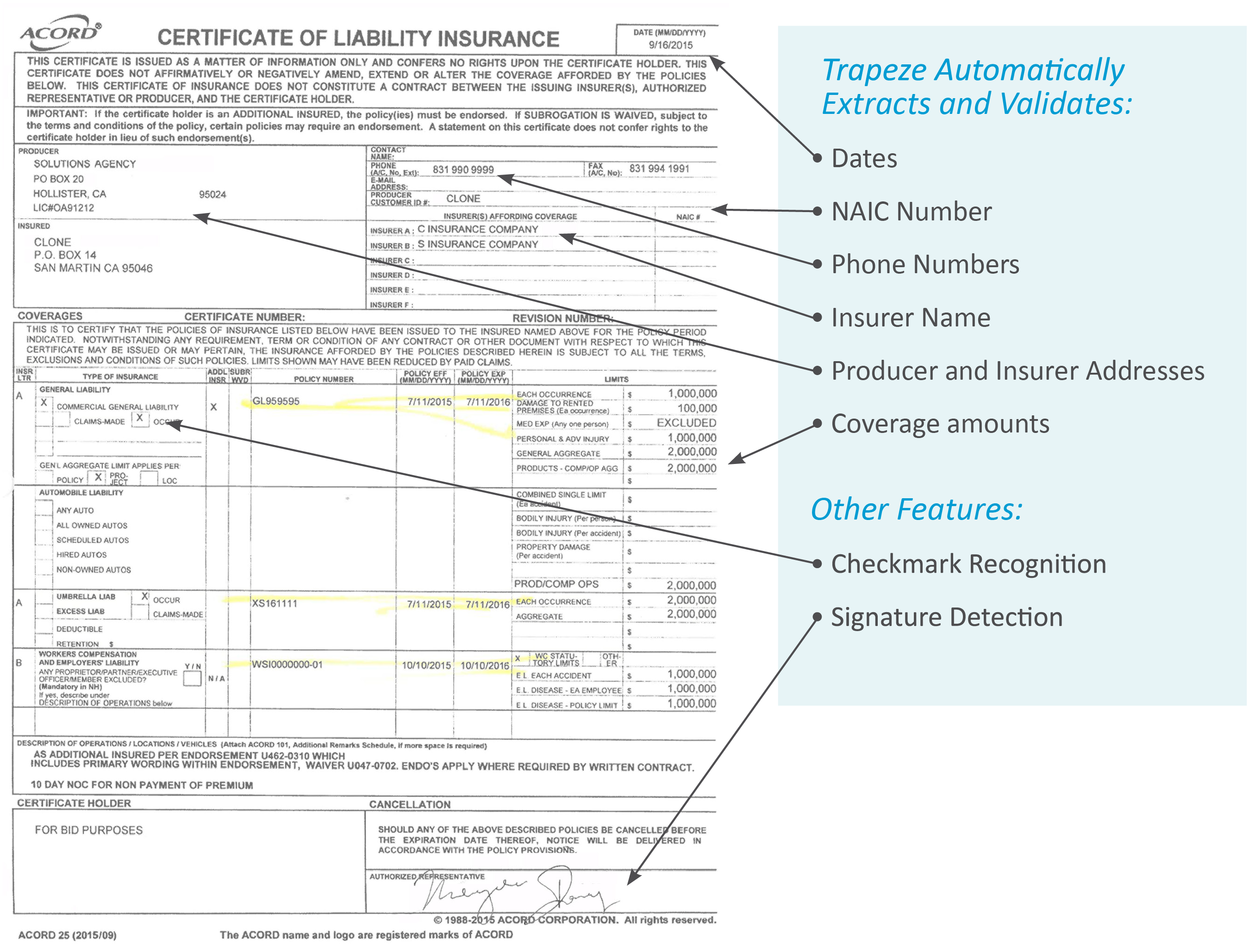

One of the key benefits to automated data capture is that it allows organizations to minimize the manual labor involved in processing insurance claims. Sophisticated automation technology can not only extract data from ACORD forms and other insurance documents, but recognize the document type and automatically classify it for proper routing. Automation promotes operational efficiency by greatly reducing the time and labor necessary to process each claim, and thereby reduces overall PMPM costs.

Trapeze automatically extracts and validates data from forms.

Faster Turnaround Time and Greater Value to Members With Claims Automation

With this newfound efficiency, insurance companies see a hard ROI from automation. But are there effects of faster insurance claims processing that extend beyond the back office?

Of course. Faster processing means faster turnaround times for plan members. After ACORD form automation, for example, insurance companies can expect to reduce processing time per form to as little as 15 seconds each. The operational efficiencies afforded by utilizing automated capture solutions translate directly to making coverage decisions faster. This means getting insurance funds to members and beneficiaries faster, and it’s an improvement in service that customers can feel. In addition to faster turnaround times, reduced PMPM costs can also be felt by front-end business in the form of lowered plan costs, or by allowing insurance companies to provide more value at existing prices with newly freed resources.

Automated claims processing is more than a back-office cost savings. It means reduced PMPM costs for insurance companies, and better value for members. In the digital age, automated capture is a necessity to compete effectively. Want to learn more about automated forms processing? Check out this white paper discussing the benefits of implementing an automated capture solution.